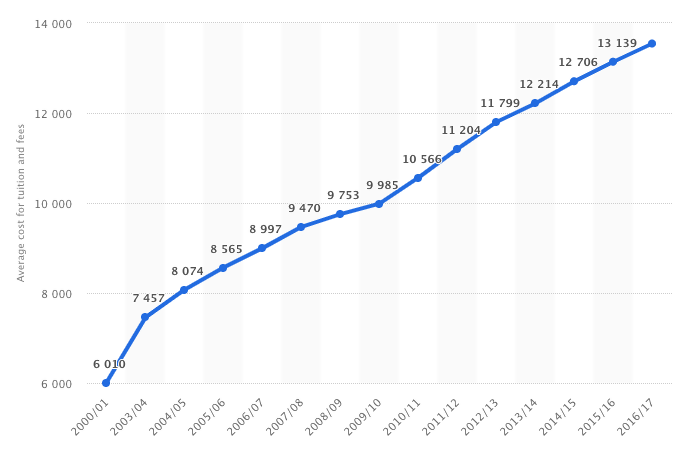

The cost of college and university tuition is rising. Big time. According to recent estimates, the average tuition cost in public colleges has more than doubled within a decade; for example, Statista claims that students had to pay $6,010 for the 2000/2001 school year but the cost has risen to $13,139 for tuition for the 2016/2017 school year. Do you know that you can save money on cheap student writing services? At https://cheappaperwriting.com/

Source: Statista

With the cost getting up to $20,000 in 2018, it’s totally safe to suggest that the trend will continue in the nearest future. Private colleges have even higher tuition costs, with the most expensive one – Harvey Mudd College – requiring $75,003 for an academic year of 2018/2019. Even though the U.S. government has expanded student support programs, 57 percent of students in the country still graduate with debt on their hands.

As a result, thousands of young high school graduates face a tough assignment of affording college tuition. In order to get a decent education, they need to explore all assignment help options that can assist them to reduce spending and earn additional income while studying.

If you’re one of these students, let’s talk about what you can do to afford college tuition in 2019 and beyond.

- Explore your Scholarship Options

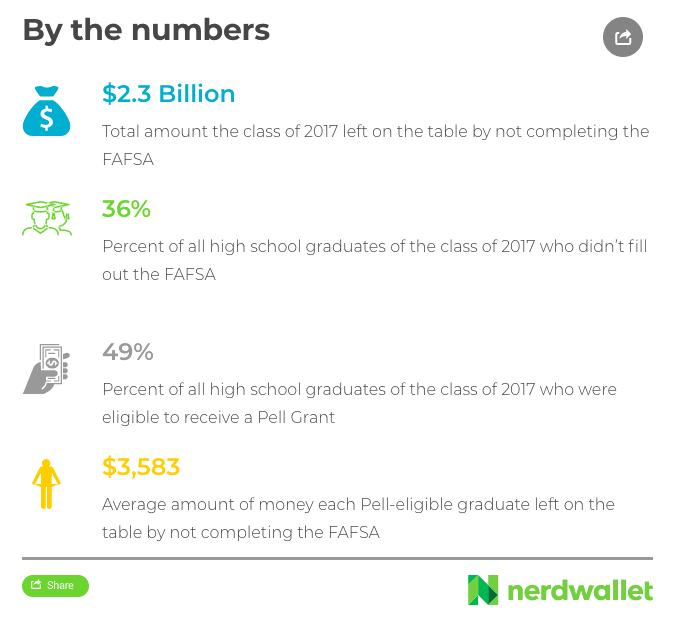

Whether you’re an international or a local student, there are a number of scholarship opportunities available to you. If you think that you’ve got no chance of getting one, listen to this. According to NerdWallet, 1,234,249 high school graduates in the U.S. didn’t fill out the FAFSA even though about half of them were eligible and could have tried to get financial help.

As a result, about $2,319,016,315 were left unclaimed. That’s unbelievable, considering the number of students leaving educational institutions with debts on their hands.

Credit: NerdWallet

For you as a U.S. citizen, this means that you should definitely check if you’re eligible for Federal Aid and fill out FAFSA within the deadlines established by the government (you can check them right here on the official page of the Office of the U.S. Department of Education). Also, check out the page with the full list of scholarships and grants.

As an international student, you should also look for scholarships. Begin your search with Googling “Scholarships for international students,” and you’ll get a large list of organizations offering financial help to students from all over the world. Be ready to visit a lot of websites and do your research; it’s still a small price to pay for getting a quality college education.

- Get a Part-Time Job

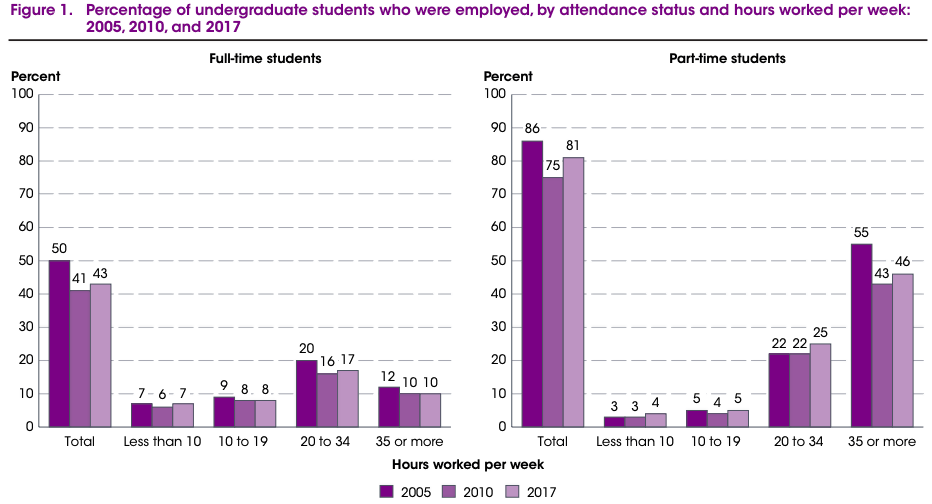

Many college students are employed to bring a steady income that can be used to purchase school supplies, pay for the accommodation, or the tuition. In fact, the latest estimates from the National Center for Education Statistics suggest that 43 percent and 81 percent of undergraduate students worked full-time and part-time, respectively, in 2017.

Source: the National Center for Education Statistics

In addition to getting additional income, working part-time can also help students to improve time management skills, gain some professional skills they can use in the future, build their network, and, ultimately, graduate with less in debt.

“Working while in college helped me to gain professional experience and made me a better time manager,” says Jenna Bailey, a student. “For example, I’m a better essay writer now, because I can prioritize my tasks and work more effectively when faced with stricter deadlines.”

- Use an Employer Reimbursement Program

Many employers are aware of the debt their student employees are facing, so they’re willing to help with making payments. This is called a tuition reimbursement program, and it means that the employer pays for the tuition for their employees.

There are multiple types of tuition reimbursement programs, for example, some of them have companies paying for education from specific universities while others guarantee the payment for approved classes only.

It’s not uncommon for companies to have such programs; for example, Starbucks is currently giving their benefits-eligible U.S-based employees working both part- and full-time 100 percent tuition coverage for a first-time bachelor’s degree through the online program from the Arizona State University.

Many other companies have similar programs; for example, Bank of America offers eligible employees up to $5,250 for job-related courses or to complete a job-related degree program.

You can find an employer offering tuition reimbursement by performing simple online research via Google or visiting a site or a selected company directly.

Don’t Miss Your Chance

Affording quality college tuition is not impossible even with a limited budget and rising costs. As you can see, there are at least three excellent ways to achieve this goal and avoid getting buried in student loan debt. Good luck!